This issuer’s offering is insured by the TigerMarkTM insurance policy. Please click here to learn more about this policy.

CASE STUDY: 267% ROI on a Texas Tax Deed Property

Property: Land parcel purchased June 2024

ACQUISITION

Purchase Price: $9,510

Improvements: $2,700 (survey & land clearing)

Total Investment: $12,210

DISPOSITION

Sale Price: $39,000

Down Payment (50%): $19,500 (cash at closing)

Seller Financing: $19,500 @ 10% interest, 3-year balloon

>INCOME OVER 3 YEARS

Interest: $1,950/year × 3 years = $5,850

Balloon Payment: $19,500 (principal)

Total Income: $44,850

RETURNS

Profit: $32,640

Total ROI: 267%

Annualized ROI: ~57% per year

TRACK RECORD

This is our 5th profitable exit out of 23 property purchases since May 2024.

Every exit to date has delivered triple-digit returns to our investors.

INVESTOR TAKEAWAY

This deal illustrates how Texas tax deeds can deliver exceptional returns by combining:

- Deeply discounted acquisition prices

- Modest improvement costs

- Seller financing for additional interest income

- Strong buyer demand for improved parcels

The Parcel Report- Q4 2025

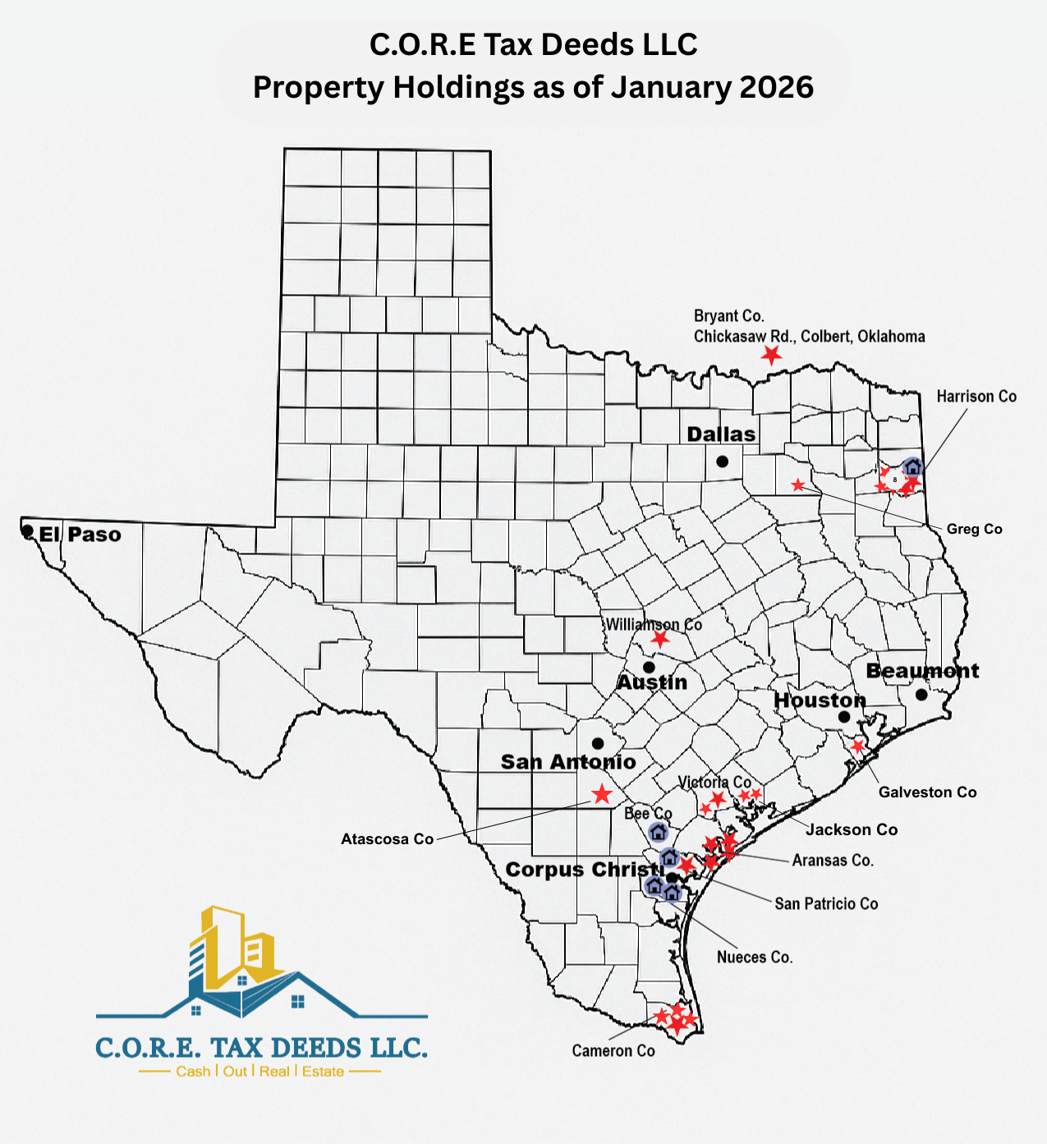

Thank you for your continued partnership. With a total of $688,500 committed by our 40 active investors, CORE Tax Deeds has grown into a uniquely positioned, asset-backed fund operating across eight counties in Texas. Your support has allowed us to build something with real, measurable value—and we’re pleased to share several updates.

Since inception, we’ve acquired 33 properties, including five residential houses, twenty-six land parcels, and several with mineral rights. These acquisitions reflect our ongoing strategy of conservative bidding, low-basis entry, and diversified geographic coverage. Based on internal estimates and comparable market data, the current portfolio has an estimated resale value of approximately $1,900,000. Actual realized values may vary based on market conditions, timing, and transaction costs.

On the operational side, we've had one redemption, completed the sale of Five properties, and now hold four promissory notes generating $1695 in monthly passive income. These activities mark the early stages of monetizing our assets and establishing recurring revenue streams. Our first distribution to Class A members was issued in March 2025. A second distribution went out in July 2025 and is expected to be completed by the time this message reaches you. CORE Tax Deeds anticipates its third distribution to investors will take place in October 2025, continuing our commitment to timely and transparent reporting. These returns demonstrate the fund's ability to both preserve capital and generate within a relatively short holding period.

Looking ahead, our goal is to raise and deploy an additional $700,000 in capital by the end of Q4 2025. This will allow us to expand into more high-yield, tax-advantaged properties-particularly incomeproducing land and residential homes that align with our existing risk-managed approach.

As always, we remain committed to disciplined execution. Our team continues to focus on acquiring clear-title assets at a discount, with full due diligence performed prior to bidding CORE Tax Deeds currently has the capacity to underwrite and bid in approximately twenty counties across Texas. This includes areas ranging from the far Northeast to the Rio Grande Valley, as well as regions throughout Central and Coastal Bend. This broad coverage enables us to maintain flexibility and diversify risk in an otherwise fragmented market.

We're just getting started. If you're considering increasing your position or introducing CORE Tax Deeds to a fellow investor, this is an ideal time.

Thank you again for being part of this journey.

The CORE Tax Deeds Team

John Berlet

invest.coretaxdeeds.com

This communication is intended for existing investors and does not constitute an offer to sell or a solicitation of an offer to buy securities. All investments carry risk. Please refer to the full Reg CF offering at invest.coretaxdeeds.com for details.

Your Gateway to Real Estate Investments

Our Story: CORE Tax Deeds was founded with a singular vision: to unlock the potential of tax deed properties in Texas. Our journey began when our founder, John Berlet, recognized the unique opportunities in the Texas tax sale market. With a background in real estate and a passion for helping investors achieve substantial returns, John set out to create a company that offers both lucrative opportunities and comprehensive support for investors.

John Berlet is the founder and fund manager of CORE Tax Deeds LLC. John has been investing in tax deeds since 1993. He is also the President of Tandem Trust Financial Group, where he focuses on crafting retirement income strategies for clients. John is a Certified Fiduciary Advisor and has been associated with ED Slott's Elite IRA Advisor program since approx. 2000.

WHAT MAKES US DIFFERENT?

Unlike many investment opportunities that are only accessible to accredited investors, our approach under Regulation CF allows almost anyone to participate. This democratization of investment opportunities means that our clients can reap the benefits of high returns and risk-managed investments.

HOW CORE TAX DEEDS WORKS

Your investment is combined with others to allow you to have uninterrupted progress in securing profits via distressed real estate encumbered by taxes owed to the cities, counties, schools, and other taxing jurisdictions. These sheriff’s deeds on property are then converted into marketable deeds and sold at wholesale. You will receive a periodic update of properties purchased & sold.

TAX DEEDS IN TEXAS

The recent shift to conducting tax deed sales online and live, as opposed to on the traditional courthouse steps, has expanded our reach. With all 254 counties in Texas, investors have a broad selection of properties. Tax Deed Investors LLC can now cover a larger number of parcels more efficiently in this evolving landscape of online auctions in Texas.

Tax Deed & Tax Lien States

➤ A Tax Lien is a legal claim against a property when the owner doesn’t pay their taxes. The government places a lien on the property and gives the owner a set amount of time to pay. If the owner doesn’t pay, the lien can be sold to a buyer at a tax lien sale. The buyer can then collect interest on the unpaid taxes. Tax liens can be a cheap investment for investors, with returns that accrue monthly as simple interest.

➤ With a Tax Deed, the government sells the property at auction to recover unpaid taxes. The starting price at the auction is usually equal to the total amount of back taxes, interest, penalties, legal costs, and other fees owed on the property. The buyer of the property takes ownership, including any unpaid taxes. The previous owner can sometimes buy back the property by paying the buyer the purchase price plus an additional fee.

INVESTMENT STRATEGY

RISK AND RETURN

Investing in Texas tax deed properties offers some of the highest returns in the market, with interest rates ranging from 25% to 50%.

Lucrative Returns

- High Interest Rates on Redemptions – In Texas, taxpayers who are late in paying property taxes must pay a penalty of 25% if they redeem their property within the first year or 180 days. If they wait two years to redeem the property, the penalty increases to 50%. This high-interest return on our investment is unmatched by other tax lien or deed states.

- Calculated Redemption Amounts – The redemption amount is based on the final bid price at auction, not the opening bid. This means that investors earn interest on the total amount invested, including any competitive bidding overage. Regardless of how quickly the property is redeemed, Texas law requires a full 25% or 50% return, unlike other states where interest rates diminish over time.

- Extensive County Coverage – With all 254 counties in Texas holding monthly auctions, CORE Tax Deeds has a broad selection of properties.

- After Auction Opportunities – Unsold properties, known as struck-off properties, can often be purchased post-auction at a discount, often without a redemption period, offering further investment potential.

- Rental Income Rights – Investors can collect rental income from properties immediately after purchase, providing a potential additional revenue stream.

RISK MANAGEMENT

While the benefits of investing in tax deed properties are substantial, we have implemented robust due diligence processes to mitigate the risks associated with property acquisition.

- Lien Research: Identify and assess all potential outstanding liens.

- Property Inspections: Personal or proxy inspections of properties are performed prior to bidding.

- Comprehensive Due Diligence: Identify any additional fees or dues not covered in the foreclosure.

- Strategic Purchases: Implement a targeted approach to acquire properties at a fraction of their market value – 30 cents to the dollar.

- Immediate Property Management: Secure and insure properties immediately after purchase.

WHY INVEST WITH CORE TAX DEEDS LLC?

- Low Minimum Investment

- You DO NOT have to be an Accredited Investor

- You may use money from your retirement account*

- You can use money from savings

Accessible to All Investors

Reg CF Accessibility: Unlike most private equity deals limited to accredited investors, our Regulation Crowdfunding (Reg CF) structure allows almost anyone to invest and benefit from our profitable opportunities.

Low Minimum Investment: With a low entry threshold, investing in Texas tax deeds is accessible to a wide range of investors.

Transparent and Regular Updates

Detailed Reports: Investors receive regular updates on property acquisitions, sales, and overall fund performance, ensuring complete transparency and confidence in their investments.

Consistent Returns: Our founder’s extensive track record shows consistent, high returns on tax deed investments with no capital losses.

Elite Advantage Program: Our Class A investors enjoy the exclusive ‘First Right to Purchase’ properties at wholesale prices, ensuring access to prime investment opportunities.

Proven Track Record and Experienced Leadership

Current Property Portfolio

The properties listed below are a sample of the purchases made at auction by CORE Tax Deeds, LLC. They represent just a portion of the current holdings of the company.

| Address | Date of Purchase | Status | Purchase Price |

|---|---|---|---|

| 2303 Coleman Ave | 05/07/2024 | SOLD - 5/2025 | $14,200 |

| 516 Sodville Ave | 05/07/2024 | UNDER CONTRACT - 5/2025 | $25,200 |

| 191 Joey Dr | 07/02/2024 | SOLD - 4/2025 | $14,800 |

| 192 Heather Dr | 07/02/2024 | SOLD - 4/2025 | $10,813 |

| 340 Lot 10 Salt Lake | 07/02/2024 | ASSET - 7/2025 | $9510 |

| 15.6 Acres, Wascom | 08/06/2024 | REDEEMED - 2/2025 | $21,000 |

| Saunders St | 04/15/2025 | SOLD - 4/2025 | $1200 |

| 6.41 Acres, Arroyo City | 03/04/2025 | ASSET - 3/2025 | $8500 |

| 1 Acre-Abstract 69, Wascom | 03/04/2025 | ASSET - 3/2025 | $4684 |

| 6.5 Acres - E Shreveport | 03/04/2025 | ASSET - 3/2025 | $12,932 |

| 3672 Old Goliad Rd. | 04/01/2024 | ASSET - 4/2025 | $5100 |

| 4805 Wexford | 05/06/2025 | ASSET - 5/2025 | $31,000 |

| 907 W Crockett | 05/06/2025 | ASSET - 5/2025 | $18,500 |

| 4720 FM 31 | 06/03/2025 | ASSET - 6/2025 | $15,833 |

| 3.43 Acres Elysian Fields | 06/03/2025 | ASSET - 6/2025 | $6,520 |

| 1.92 Acres Gerusa Rd | 07/01/2025 | ASSET – 7/2025 | $9,100 |

| 5.82 Acres Osborn Rd | 07/01/2025 | ASSET – 7/2025 | $10,100 |

| 2696 Lot Christine, TX | 10/07/2025 | ASSET – 10/2025 | $834 |

| Lot 33 Mullet BOCA CHICA | 11/02/2025 | ASSET - 11/25 | $2,474 |

| Lot 53 BOCA CHICA | 11/02/2025 | ASSET - 11/25 | $3,500 |

| 4203 Hanselman Rd VICTORIA | 11/02/2025 | ASSET - 11/25 | $10,411 |

| 2864 S FM 9 WASKOM | 12/02/2025 | ASSET - 12/25 | $3,400 |

| Lot 9 COTTONWOOD DR | 12/02/2025 | ASSET - 12/25 | $760 |

| Lots 9-10 Blk A LAKE DEERWOOD | 12/02/2025 | ASSET - 12/25 | $920 |

| .69 acre - 102 PRIVATE RD LONGVIEW | 12/02/2025 | ASSET - 12/25 | $8,827 |

| VACANT LOTS ON BOLIVAR PENINSULA | 01/06/2026 | ASSET - 01/26 | $14,100 |

Note: Past performance does not guarantee future results.

Strategy Property Portfolio Overview

(May 2024 – October 2025)

Between May 2024 and October 2025, the CORE Tax Deeds Management Team, in partnership with our investors, successfully acquired a diverse portfolio of 25 properties across Texas with a combined asset value exceeding $1.3 million.

These acquisitions were completed through disciplined participation in county tax deed auctions, typically at a fraction of assessed market value, allowing for strong equity positions from day one.

Monetization of these assets began in March 2025, and as of this report, six of our first ten tax deed purchases have completed full exit cycles, demonstrating the model’s ability to convert non-performing properties into productive, income-generating assets within months of acquisition.'

Portfolio Composition

- 5 Residential Houses – primarily non-homesteaded, ready for resale or improvement

- 7 Small Acreage Tracts – ideal for rural residential or agricultural use

- 3 Commercial Lots – positioned for redevelopment or strategic sale

- 1 15.6-Acre Parcel – featuring a small pond and producing mineral rights

- 4 Parcels (6+ acres each) – suited for subdivision or long-term hold

- 5 Infill Residential Lots – located within established neighborhoods, ready for construction

JOIN US AT C.O.R.E TAX DEEDS LLC TODAY!

To Learn More

Together, we can achieve remarkable financial growth and secure your future.

Why Watch the Stock Market and Worry About the Roller Coaster?